Introduction

The cryptocurrency market is one of the most dynamic and unpredictable financial arenas in the world. Prices can swing dramatically within hours, trading volumes spike and drop in seconds, and new tokens or technologies emerge almost every day. For beginners and even experienced traders, staying on top of this constant flow of information is overwhelming.

Traditionally, investors have relied on manual research, technical chart analysis, or advice from professional analysts to make decisions. While these methods can be valuable, they are often time-consuming, prone to bias, and limited by human capacity to process data at scale. In a market that never sleeps, even a slight delay in reaction can mean missing out on opportunities—or worse, facing unexpected losses.

This is where the AI Crypto Analyst comes in. By leveraging artificial intelligence, these tools analyze massive amounts of market data in real time, identify emerging trends, predict potential price movements, and provide actionable insights that empower smarter decision-making. For beginners, an AI Crypto Analyst offers a gateway into the crypto world without requiring deep technical expertise. For seasoned investors, it delivers speed and precision that manual analysis simply cannot match.

What Is an AI Crypto Analyst?

An AI Crypto Analyst is a digital tool or platform powered by artificial intelligence that helps investors understand and navigate the cryptocurrency market. Instead of relying solely on manual chart reading or human analysts, these systems use advanced algorithms, machine learning models, and natural language processing to process vast amounts of data and deliver meaningful insights.

At its core, an AI Crypto Analyst can:

Track real-time price movements and trading volumes.

Forecast short- and medium-term price trends based on historical data and predictive modeling.

Monitor news articles, social media posts, and community discussions to gauge overall market sentiment.

Provide portfolio recommendations and risk alerts tailored to an investor's preferences.

The biggest difference between an AI-powered analyst and traditional analysis methods is scale and speed. While a human analyst might take hours to study a single cryptocurrency, an AI system can evaluate hundreds of assets simultaneously, updating its insights every second.

For beginners, this means access to professional-level analysis without requiring years of trading experience. For active traders, it means having a reliable partner that cuts through the noise and highlights opportunities as they emerge.

Core Functions of an AI Crypto Analyst

An AI Crypto Analyst isn't just a single feature—it combines multiple layers of analysis to give investors a holistic view of the market. Below are the core functions you can expect from most AI-powered crypto analysis platforms.

Market Trend Tracking

One of the main strengths of an AI Crypto Analyst is the ability to monitor market activity in real time. Instead of scanning charts manually, the AI automatically processes trading volumes, price fluctuations, and on-chain activity across dozens—or even hundreds—of cryptocurrencies. This enables investors to quickly spot upward momentum, downward pressure, or unusual activity that might signal a new trend.

Price Prediction Models

By using machine learning algorithms, AI Crypto Analysts can forecast potential price movements. These models are trained on historical price data, technical indicators, and macroeconomic factors. While predictions are not guarantees, they give investors a clearer picture of possible market scenarios, making it easier to plan entry and exit strategies.

Sentiment Analysis

Markets are not driven by numbers alone—investor psychology plays a huge role. An AI Crypto Analyst can scan news articles, tweets, Reddit posts, and forum discussions to evaluate the overall sentiment toward a coin or the market as a whole. This insight helps investors understand whether optimism, fear, or uncertainty is dominating the conversation, which can strongly influence short-term price moves.

Portfolio Optimization and Risk Management

Beyond tracking individual coins, AI tools also assist with managing an investor's overall portfolio. They can suggest diversification strategies, highlight risky concentrations, and issue alerts when exposure to a specific asset becomes too high. For beginners, this guidance reduces the chances of making common mistakes, while advanced traders benefit from better risk-adjusted returns.

Advantages of Using an AI Crypto Analyst

The crypto market moves fast, and relying on traditional research methods often isn't enough. By using an AI Crypto Analyst, investors gain several key advantages that make trading and investing more efficient, informed, and less stressful.

1. Data-Driven Decision Making

Instead of reacting based on gut feelings or social media hype, an AI Crypto Analyst grounds decisions in hard data. This reduces emotional trading mistakes and helps investors focus on real opportunities backed by measurable insights.

2. Real-Time Market Insights

Unlike human analysts, AI systems never sleep. They continuously track prices, sentiment, and on-chain activity, ensuring that you don't miss critical changes in the market. This is especially valuable in crypto, where a single news event can move prices dramatically within minutes.

3. Lower Entry Barriers for Beginners

For newcomers, the world of crypto charts, technical indicators, and trading signals can feel overwhelming. An AI Crypto Analyst simplifies this complexity, offering clear, digestible insights without requiring years of trading experience.

4. Scalability and Efficiency

AI tools can analyze hundreds of assets at once, something impossible for a single person to achieve. For both beginners and advanced traders, this scale means broader market coverage and faster decision-making, without being overwhelmed by data overload.

In short, the advantage of an AI Crypto Analyst lies in speed, accuracy, and accessibility—helping both beginners and professionals trade smarter, not harder.

Recommended AI Crypto Analyst Tools in 2025

With the growing interest in AI-powered crypto analysis, a wide range of tools have entered the market. Some are designed for beginners who want a simple way to understand market movements, while others cater to professional traders who demand advanced features. Below are some of the top AI Crypto Analyst tools in 2025, starting with the most beginner-friendly option.

1. Powerdrill Bloom — Best for Beginners and Free Access

Powerdrill Bloom positions itself as an accessible yet powerful AI Crypto Analyst platform. Its free plan makes it easy for newcomers to explore AI-driven market insights without committing to a subscription.

Key strengths of Powerdrill Bloom include:

AI-powered dashboards that track real-time market trends.

Predictive analysis for identifying potential price movements.

Portfolio guidance with diversification suggestions and risk alerts.

For beginners, Powerdrill Bloom provides professional-level insights in a simplified interface, lowering the entry barrier into crypto investing. For more advanced users, the platform also offers premium upgrades with expanded features.

2. CryptoPrediction.ai — Focused on Price Forecasting

This platform specializes in price predictions by analyzing historical data and applying machine learning models. While less comprehensive than all-in-one solutions, it appeals to users who want straightforward forecasts for specific coins.

3. CoinMarketCap AI Insights — Market Data at Scale

As one of the most popular crypto data platforms, CoinMarketCap integrates AI to deliver deeper market insights. Users benefit from access to one of the largest data sets in the industry, though advanced AI features are more limited compared to dedicated platforms.

4. TradingView AI Signals — For Technical Traders

Known for its charting tools, TradingView has introduced AI signals that enhance traditional technical analysis. This hybrid approach appeals to traders who already rely heavily on chart patterns but want to augment their strategies with AI-driven suggestions.

Choosing the Right Tool

For beginners or those testing the waters, Powerdrill Bloom stands out as the best free AI Crypto Analyst tool in 2025. It balances accessibility with powerful functionality, making it a reliable starting point before transitioning into more advanced or specialized platforms.

How to Get Started with an AI Crypto Analyst (Step by Step)

Using an AI Crypto Analyst may sound complex at first, but in practice, it's straightforward—especially with modern platforms designed for accessibility. Here's a simple step-by-step process to help beginners start using AI for crypto insights.

Step 1: Choose Your Platform

Start by selecting an AI crypto analysis tool that fits your needs. If you're new to the space, Powerdrill Bloom is an excellent entry point thanks to its free plan and user-friendly interface.

Step 2: Sign In and Enter Your Topic

Here we use Powerdrill Bloom as an example.

Sign in to Powerdrill Bloom.

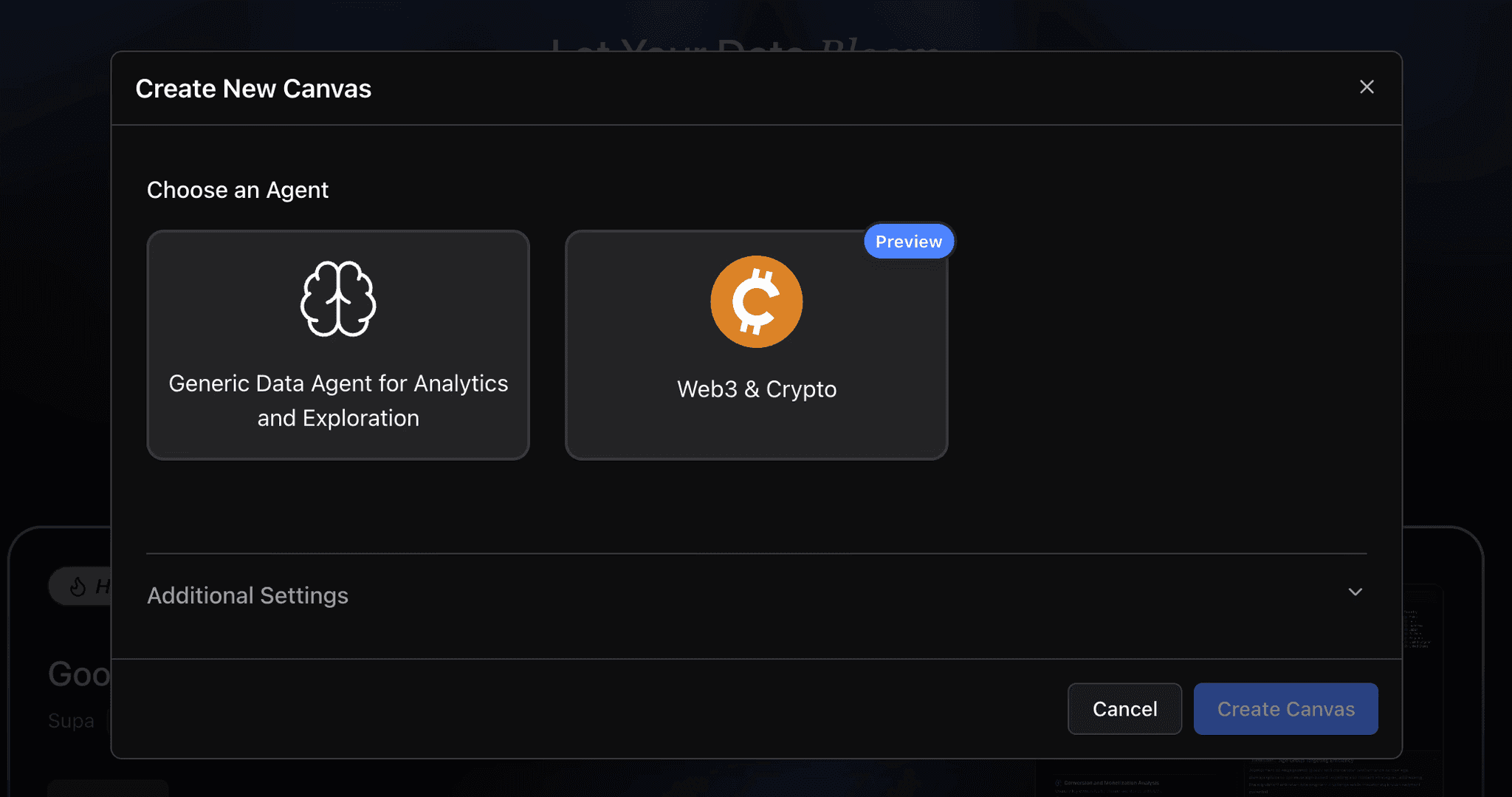

Click Start Blooming, choose Web3 & Crypto, and click Create Canvas.

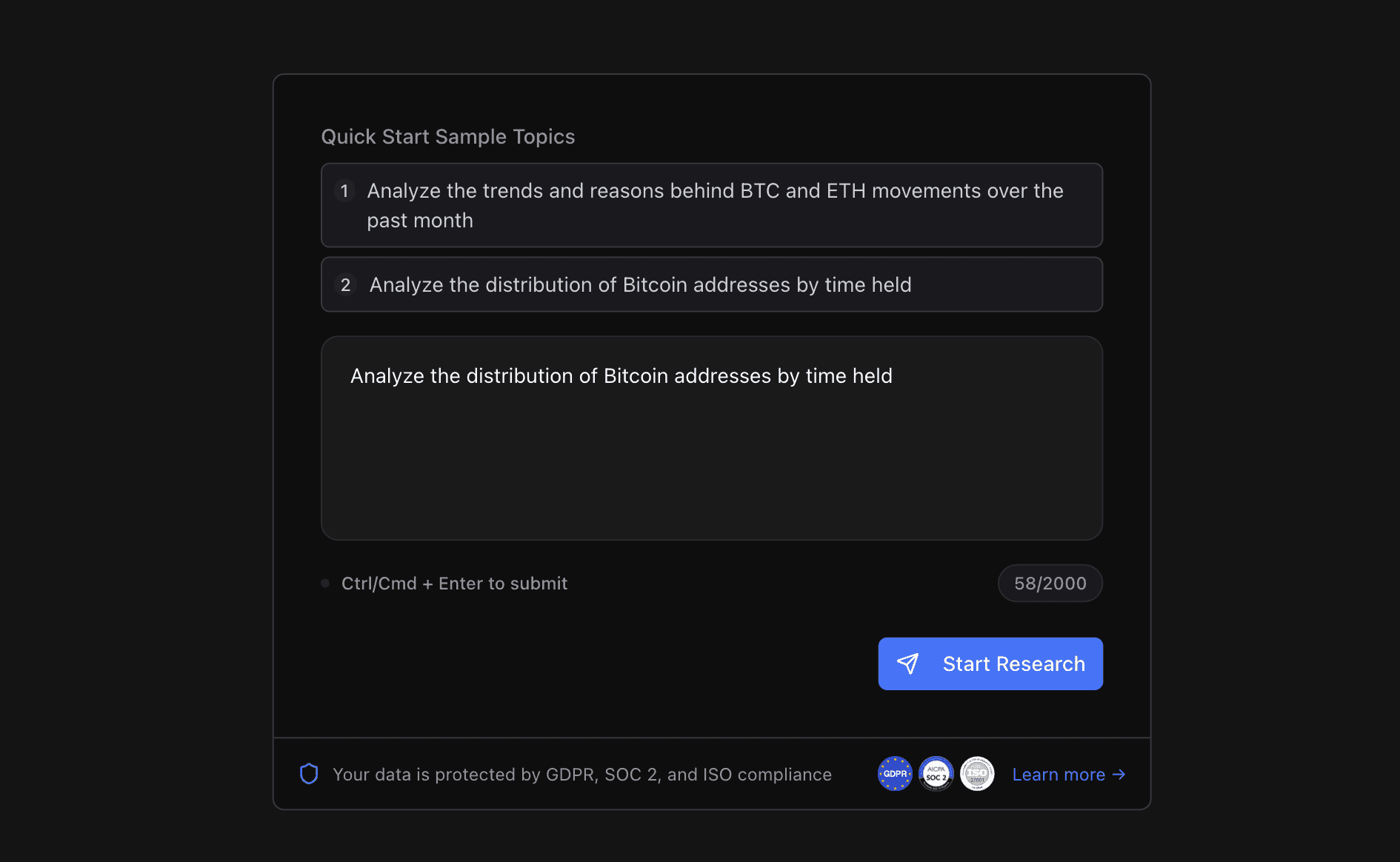

Enter your topic, for example, "Analyze the distribution of Bitcoin addresses by time hold", and click Start Research.

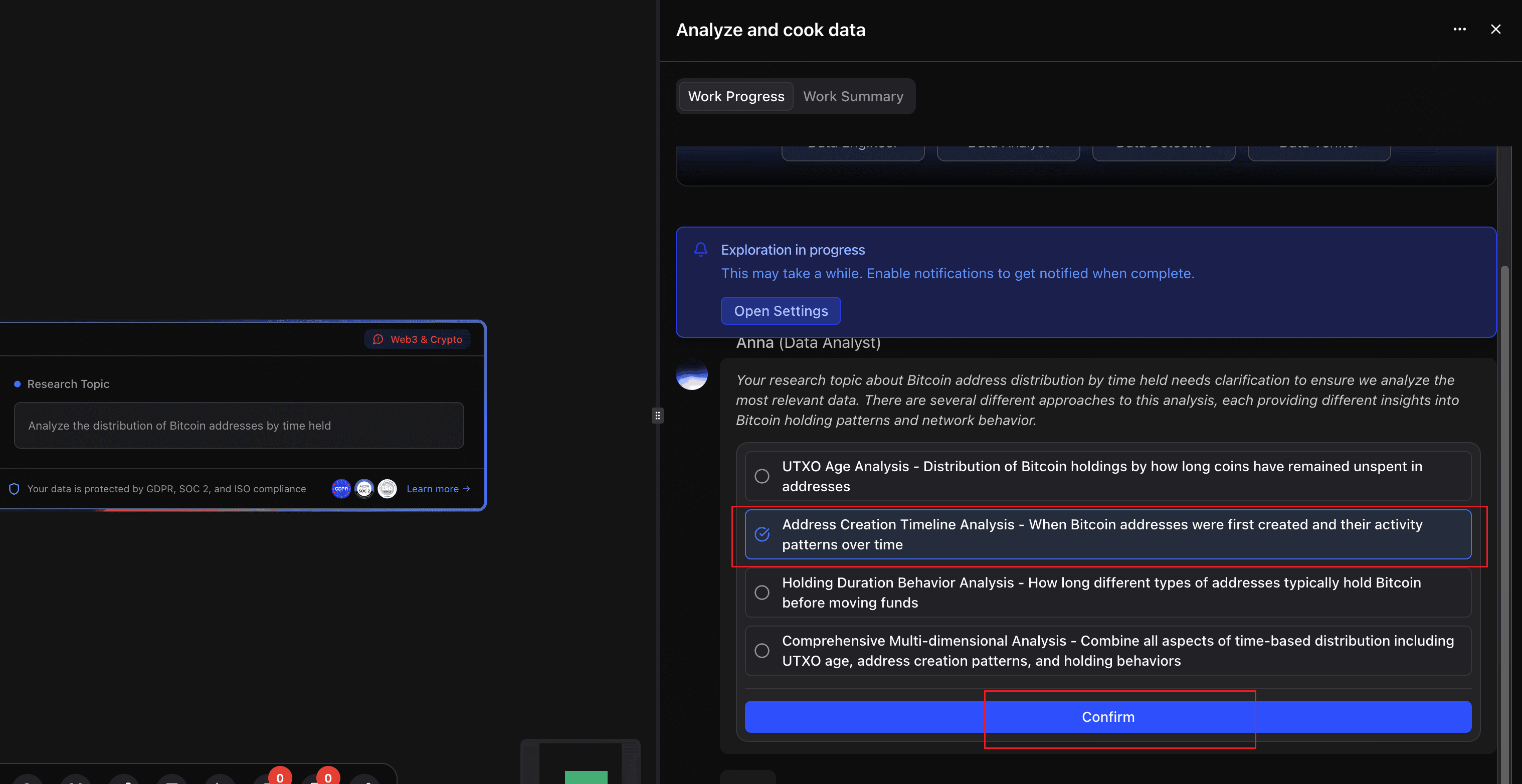

Select your option, for example, "Address Creation Timeline Analysis - When Bitcoin addresses were first created and their activity patterns over time", and click Confirm.

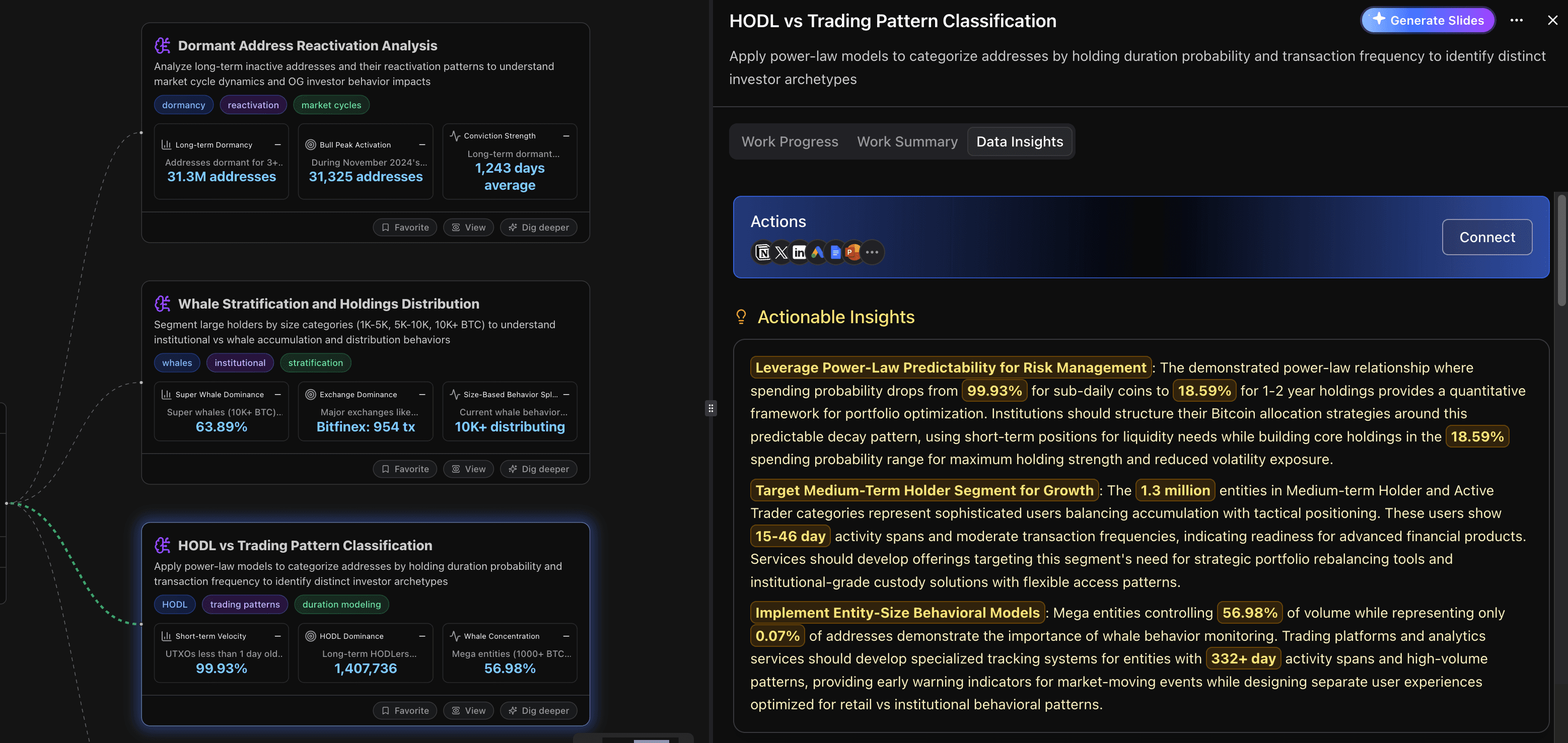

Then, you can view the exploration results on the canvas.

Step 3: Apply Insights to Your Strategy

Use the AI's recommendations to inform your decisions. For beginners, this might mean watching for buy/sell signals, testing different portfolio strategies, or simply learning how market sentiment shifts affect prices. Always start small or use demo trading features where available.

Frequently Asked Questions (FAQ)

1. Can an AI Crypto Analyst fully replace human analysts?

Not entirely. AI tools excel at processing vast amounts of data in real time, but human analysts provide context, intuition, and strategic thinking. The best results come from combining both.

2. Are free AI Crypto Analyst tools reliable?

Yes, but with limitations. Free tools like Powerdrill Bloom offer accurate insights for beginners, though they may include fewer features compared to premium plans. They're perfect for learning and testing strategies without financial risk.

3. Will AI crypto analysis always predict the market correctly?

No prediction is 100% accurate, whether from humans or AI. Instead, AI provides probabilities and scenarios based on data patterns. It's best used as a decision-support tool, not a guarantee.

4. Is an AI Crypto Analyst suitable for long-term investors?

Absolutely. Long-term investors can use AI to track portfolio performance, identify diversification opportunities, and stay informed about market sentiment. The insights are useful for both day traders and long-term holders.

5. What's the best free AI Crypto Analyst for beginners?

Powerdrill Bloom is one of the best options in 2025. It combines accessibility, free entry-level features, and AI-driven dashboards designed to simplify complex market data.

Conclusion

The cryptocurrency market is fast-paced, data-heavy, and often intimidating—especially for newcomers. An AI Crypto Analyst bridges the gap, turning overwhelming streams of information into actionable insights. Whether you're looking to understand market trends, test price predictions, or optimize your portfolio, AI tools make the process faster, smarter, and more accessible.

For beginners, starting with a free AI Crypto Analyst like Powerdrill Bloom is the most practical step. It offers professional-level insights without cost, helping you gain confidence in crypto trading before deciding whether advanced features are necessary.

In a market where every second counts, having AI on your side isn't just an advantage—it's quickly becoming a necessity.

Ready to experience it yourself? Try Powerdrill Bloom's Free Plan today and see how AI can transform the way you analyze crypto.