How to Improve Your Predictions with AI-Driven Time Series Forecasting on Powerdrill

Flora

Jan 3, 2025

What Is Time Series Forecasting?

Time series forecasting is the process of predicting future values based on previously observed data points, which are typically ordered chronologically. It plays a crucial role in various domains, including finance, retail, energy, and beyond. By analyzing patterns such as trends, seasonality, and cycles within the data, time series forecasting helps businesses and organizations anticipate future events and make informed decisions. From stock prices to sales volumes, effective forecasting is essential for risk management, resource allocation, and long-term strategic planning.

Applications in Time Series Forecasting

Finance

In finance, time series forecasting is particularly important for predicting stock market trends, exchange rates, interest rates, and other financial metrics. By leveraging historical data, financial institutions can make predictions about market movements, which helps them mitigate risk, improve investment strategies, and forecast the financial health of companies and economies. Time series forecasting also plays a critical role in managing portfolios and planning for future financial events such as market crashes or economic growth periods.

Retail

For retail businesses, accurate demand forecasting can significantly enhance inventory management, supply chain planning, and sales strategies. Time series forecasting helps predict consumer demand patterns, seasonal trends, and potential sales spikes during holidays or special events. Retailers can optimize stock levels, avoid stockouts, and reduce overstocking, ultimately improving customer satisfaction and profitability. Forecasting can also be used to predict pricing trends, helping businesses adjust their pricing models accordingly.

Energy

The energy sector heavily relies on time series forecasting for predicting demand and supply fluctuations. This is particularly important for managing electricity grids, optimizing energy production, and determining pricing strategies. With the increasing use of renewable energy sources like solar and wind, which are dependent on weather conditions, accurate forecasting becomes even more critical. By forecasting energy consumption and production levels, utilities can plan for future energy requirements, avoid outages, and minimize costs.

AI Models and Algorithms for Time Series Forecasting

Over the years, various artificial intelligence (AI) models and algorithms have been developed to improve the accuracy of time series forecasting. Below are some of the most common approaches used today:

Prophet Model

The Prophet model, developed by Facebook, is one of the most widely used forecasting methods. It is based on an additive model that accounts for trends, seasonality, and holidays. Prophet is particularly useful for handling irregular time series data with missing values or outliers. Its flexibility in modeling various types of seasonality makes it suitable for a wide range of industries, from retail to finance. The model is user-friendly and can be used with minimal expertise in time series analysis. For longer prediction horizons, Powerdrill typically defaults to using the Prophet model.

ARIMA Model

ARIMA (AutoRegressive Integrated Moving Average) is a classical time series forecasting model that combines three components:

AutoRegressive (AR): Uses the relationship between an observation and a number of lagged observations (previous values).

Integrated (I): Involves differencing the time series to make it stationary (removing trends).

Moving Average (MA): Uses the relationship between an observation and residual errors from a moving average model applied to lagged observations.

ARIMA is widely used in finance, economics, and other fields where the time series data is stationary or can be made stationary through differencing. It is effective for predicting values when there are no clear seasonal patterns.

Autoregression Model

Autoregression is a component of ARIMA that focuses on using the past values in a time series to predict future values. In autoregressive models, the prediction is based solely on past data points and assumes that past values have a direct influence on future values. It is particularly useful when there is a strong temporal dependency in the data, such as with stock market prices or sales data. The autoregression model in Powerdrill uses the AIC (Akaike Information Criterion) algorithm to select the most optimal parameters.

Other Models: RNNs, LSTM, CNNs

Recurrent Neural Networks (RNNs): RNNs are neural networks designed for sequence data, making them ideal for time series forecasting. They are capable of capturing temporal dependencies in data, but they may struggle with long-term dependencies due to the vanishing gradient problem.

Long Short-Term Memory (LSTM): LSTM networks are a type of RNN that can better capture long-term dependencies by using memory cells. They are particularly effective for time series forecasting tasks involving complex patterns and long sequences of data, such as weather forecasting or demand prediction.

Convolutional Neural Networks (CNNs): Though primarily used in image processing, CNNs have also been successfully applied to time series forecasting. By treating time series data as a 1D signal, CNNs can extract hierarchical features from the data, making them suitable for forecasting in domains like energy and finance.

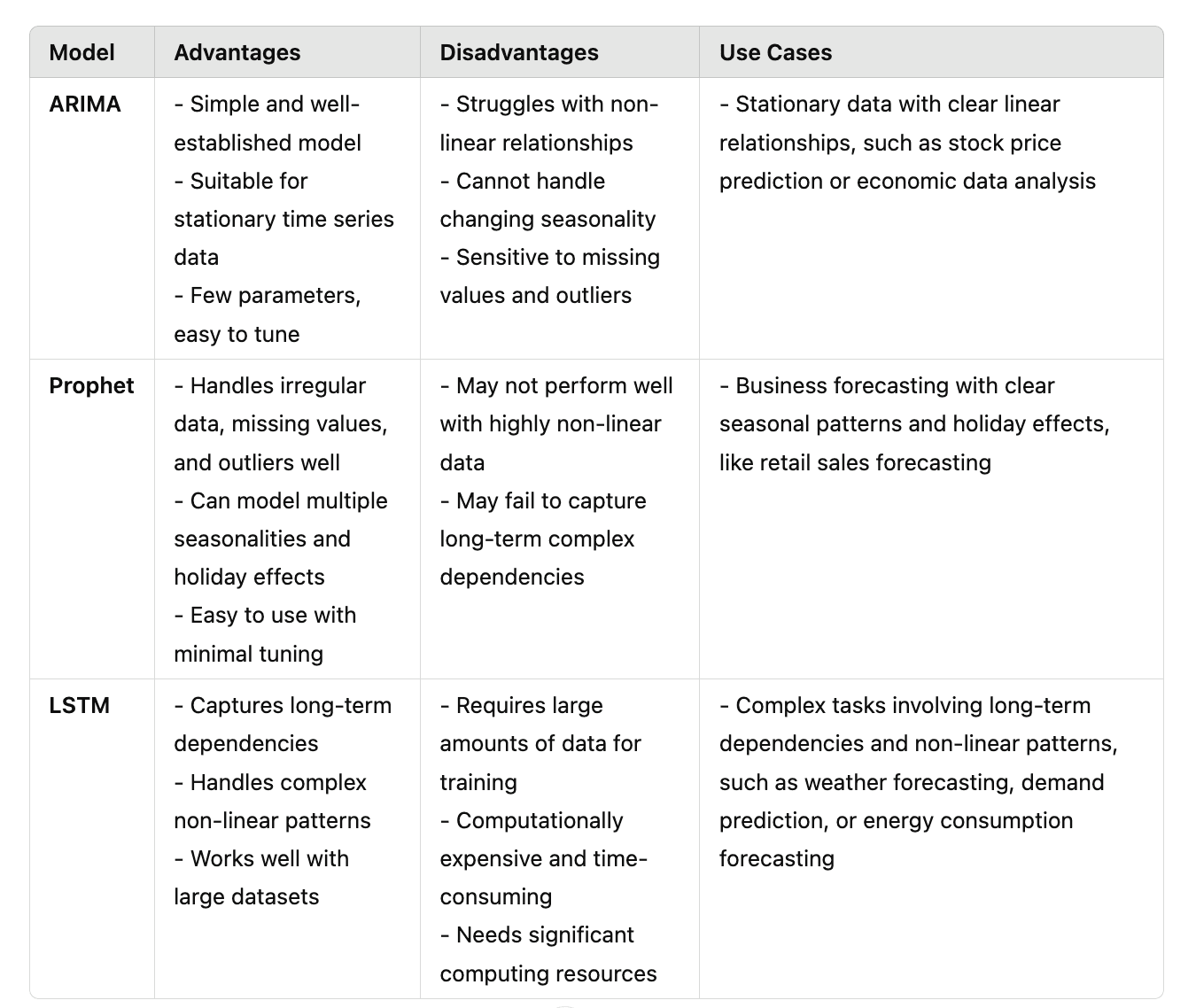

Comparison: ARIMA vs Prophet vs LSTM

Each of the time series forecasting methods has its own advantages and limitations, and the best model depends on the nature of the data and the specific forecasting needs.

Summary

ARIMA is best suited for stationary time series data and works well when there are clear linear relationships. It is especially effective with smaller datasets when the Hyndman-Khandakar algorithm is used.

Prophet excels in handling irregular data and long-term predictions, particularly when dealing with seasonal patterns, holidays, and missing values. Powerdrill prefers Prophet for longer prediction horizons.

LSTM models are ideal for handling non-linear relationships and long-term dependencies, especially in large datasets. However, they require significant computational resources and data volume.

When to Choose Which Model

ARIMA: Best for simpler, stationary time series with a clear autoregressive structure and small datasets.

Prophet: Ideal for data with missing values, outliers, or multiple seasonalities, especially for long-term forecasting.

LSTM: Excellent for large datasets with non-linear, long-term dependencies and complex patterns.

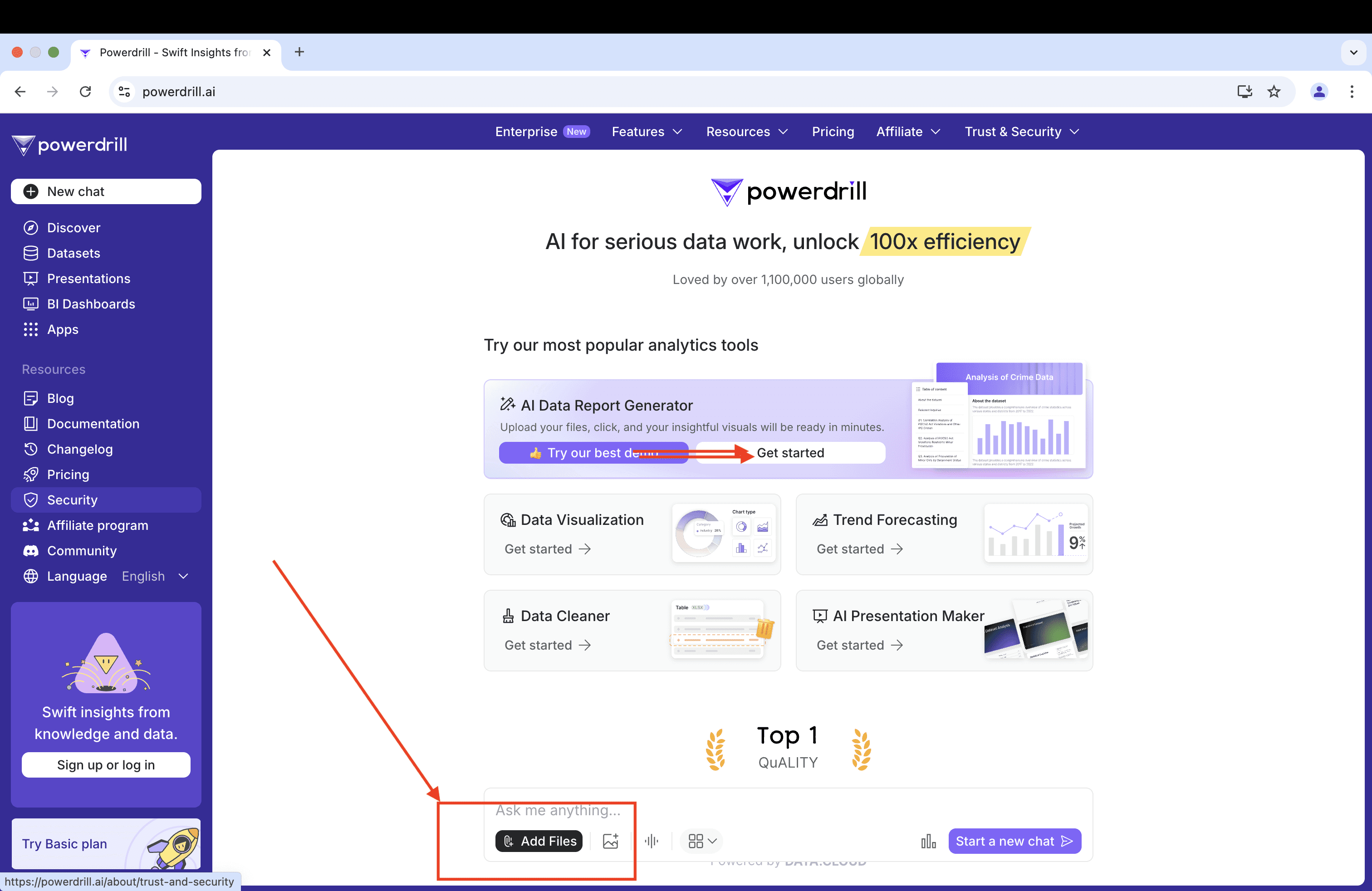

Getting Started with AI for Time Series Forecasting with Powerdrill

Powerdrill, an advanced AI-driven data analysis platform, makes it easier for businesses to leverage time series forecasting without requiring deep expertise in data science.

Powerdrill’s user-friendly interface allows users to upload historical time series data, and the platform automatically selects and applies the most suitable forecasting model based on the dataset and user query. All predictions come with a confidence level of 95%.

Here’s how you can get started with time series forecasting on Powerdrill:

Upload Your Data: Import your time series data (e.g., sales, stock prices, energy consumption) into the Powerdrill platform.

Select the Forecasting Model: Based on your dataset and query, Powerdrill will automatically choose the appropriate model—whether it’s ARIMA, Prophet, or Autoregression Model.

If the prediction horizon is long, Powerdrill typically defaults to using the Prophet model, which is particularly well-suited for longer forecasts.

The autoregression model uses the AIC algorithm to select the most optimal parameters.

For smaller datasets (fewer than 10,000 rows), Powerdrill applies the Hyndman-Khandakar algorithm for ARIMA model parameter selection.

For larger datasets (10,000 rows or more), the ARIMA model uses default parameter settings.

Get Instant Insights: Powerdrill’s AI will analyze the data, generate forecasts, and provide actionable insights.

Visualize Results: View the predicted future values, trend lines, and seasonality effects with intuitive charts and graphs.

Refine Predictions: Fine-tune parameters to improve accuracy based on your business context.

With Powerdrill, you can save time and resources while still making data-driven decisions that help your business grow and adapt to changing market conditions.

Conclusion

Time series forecasting is a powerful tool for predicting future trends based on historical data. Whether you’re in finance, retail, or energy, using the right forecasting model can provide a significant competitive advantage. From traditional models like ARIMA to advanced AI methods like LSTM, there are various techniques to choose from, each with its strengths and weaknesses.

With Powerdrill, businesses can easily leverage these models in a simple, automated way, unlocking the potential of AI-driven forecasting without needing deep technical expertise. Start using Powerdrill today to gain more accurate insights and make better-informed decisions for your business.